Instead of building each invoice from scratch and tracking payments in a separate file, you can create branded invoices in minutes, send them directly to clients, and see exactly when they’re viewed or paid.

Table of Contents

- 1 What is Invoice Management Software?

- 2 The 15 Best Invoice Management Solutions for 2025 (Features + Pricing)

- 3 Wrapping Up: Who Should Invest in Invoice Management Software in 2025

- 4 FAQs on Invoice Management Software

What is Invoice Management Software?

The pricing structure is as follows:The invoicing functionality is not sold as a separate product but is a core feature included in all FreshBooks subscription plans.  $

$

How Invoice Management Software Works

Once an invoice is in the system, it becomes the central hub for all activities, including questions for approvers, stakeholder clarification, and related documentation. This ensures that the entire history of an invoice’s lifecycle, from receipt to approval, is contained in one auditable location.

- Create – Pick a template, add your logo, enter client details, and list products or services. The system calculates totals, taxes, and discounts automatically.

- Send & Track – Email the invoice straight from the platform and see when it’s sent, opened, and paid.

- Remind – Set up automatic reminders for upcoming or overdue payments.

- Get Paid – Add a “Pay Now” button linked to gateways like Stripe, PayPal, or Square for instant payment.

- Report – View real-time data on revenue, outstanding invoices, and tax collected.

In addition to invoicing, Swipe offers a suite of complementary features, including inventory management, expense tracking, business reporting (including GSTR-1), and the ability to create a simple “online store” to showcase products.

Top Features to Look for in the Best Invoice Management Software

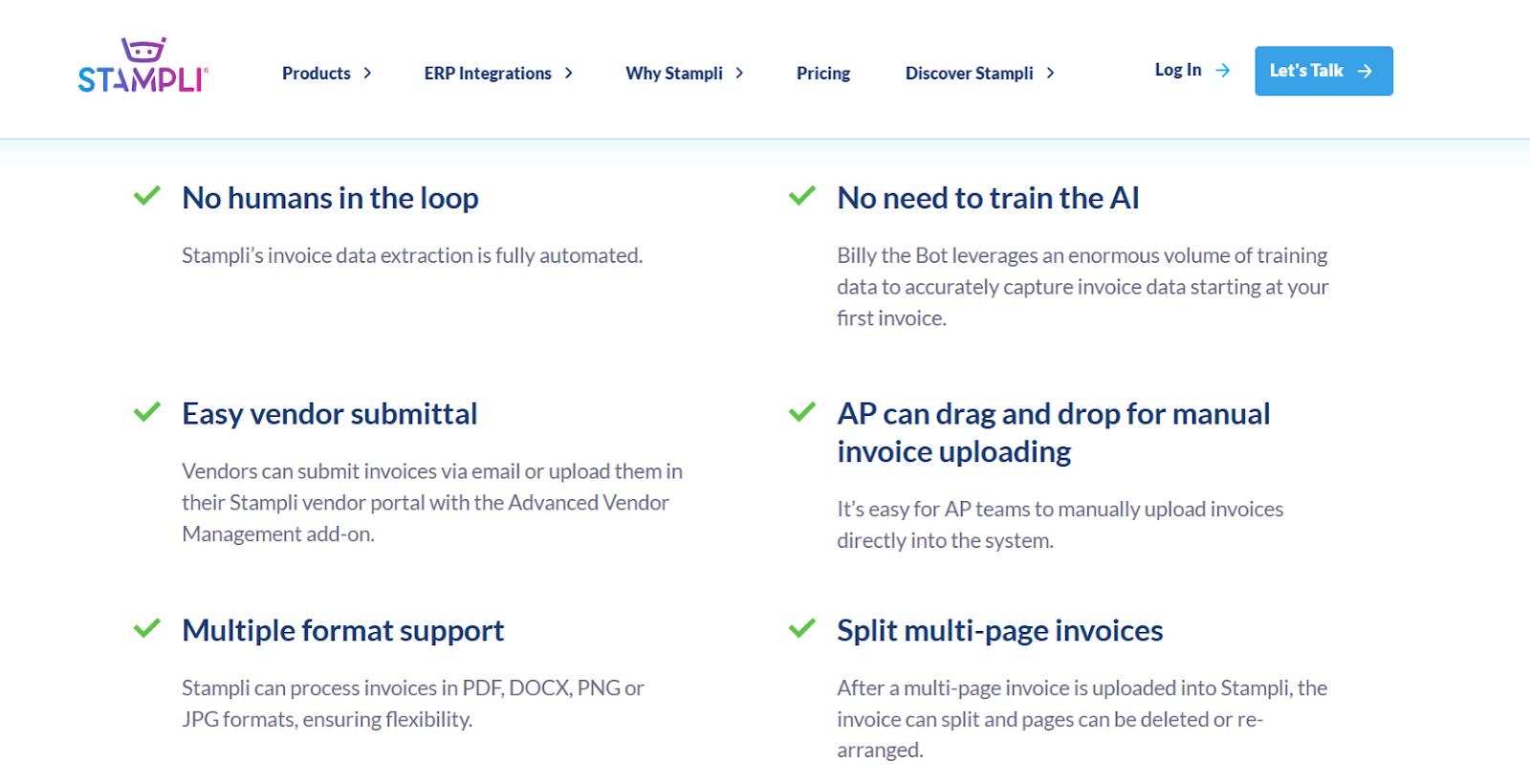

Stampli offers an Accounts Payable automation platform emphasizing centralizing communication and collaboration directly on top of the invoice. Its core philosophy is eliminating the need for external email threads and disjointed conversations when resolving invoice-related queries.

- Customizable Invoice Templates: Look for the ability to easily add your logo, adjust colors, and modify the layout to create professional invoices that reflect your brand identity.

- Automation Capabilities: The best software automates key tasks. This includes setting up recurring billing for retainer clients, scheduling future invoices, and, most critically, sending automated late-payment reminders.

- Online Payment Gateway Integration: This is an important feature for getting paid quickly. Ensure the software integrates with popular and trusted payment gateways so clients can pay you with a single click.

- Real-Time Invoice Tracking: The ability to see the status of an invoice (e.g., Sent, Viewed, Paid, Overdue) in real-time provides clarity and helps you manage your cash flow more effectively.

- Robust Reporting and Analytics: Your software should provide clear, easy-to-understand reports on your income, expenses, outstanding invoices, and payment history to help you make informed business decisions.

- Integrations with Other Tools: Check for compatibility with your existing software, such as accounting platforms (like QuickBooks or Xero), CRM systems, or project management tools, to create a seamless workflow.

- Mobile Accessibility: A dedicated mobile app or a mobile-responsive web interface is essential for managing your business on the go. These apps allow you to send invoices and check payment statuses from anywhere.

- Multi-Currency and Multi-Language Support: This feature is non-negotiable if you work with international clients. It allows you to bill clients in their local currency and language, simplifying the process for everyone.

Once an invoice is sent, businesses can set up automatic reminders to chase late payments without manual effort. Additionally, when a client pays via an integrated payment gateway like Stripe or GoCardless, the payment is automatically matched against the invoice and reconciled with the corresponding bank transaction. This significantly reduces administrative work and ensures that financial records are always up-to-date.

The 15 Best Invoice Management Solutions for 2025 (Features + Pricing)

#1 – Rossum

The goal is simple: cut down on admin, speed up payments, and give your business a more professional edge.Although specific costs are customized, Yooz offers a more transparent pricing structure than many enterprise-level competitors. The company provides a tailored quote based on the client’s needs but frames its plans around clear tiers. The model is structured as follows:

Pricing and Subscription Plans

Invoice management software focuses on creating, sending, and tracking invoices. Accounting software includes invoicing but also handles the rest of your financial operations – bookkeeping, expense tracking, reporting, and tax preparation.When an invoice is created, it directly impacts inventory levels and accounting ledgers in real-time. The system also features a customer portal where clients can view their invoices, track payment status, and pay online through integrated payment gateways like Stripe and PayPal. This holistic approach makes it a powerful option for businesses looking for a single, scalable system that can grow with them from a simple invoicing tool into a full-fledged Enterprise Resource Planning solution.

#2 – Tipalti Invoice Management

Swipe is a mobile-focused application designed to serve as an all-in-one business management tool for freelancers, solopreneurs, and small businesses in India. It is mainly built to create and manage GST-compliant invoices quickly. The platform is distinctly tailored to the Indian market, integrating natively with ubiquitous payment and communication channels in the region.Additionally, the platform can convert machine-readable e-invoices into human-readable PDFs for auditing purposes and integrates with major ERP and business systems, including SAP, NetSuite, and Workday, to ensure data flows smoothly into your existing financial ecosystem.

Pricing and Subscription Plans

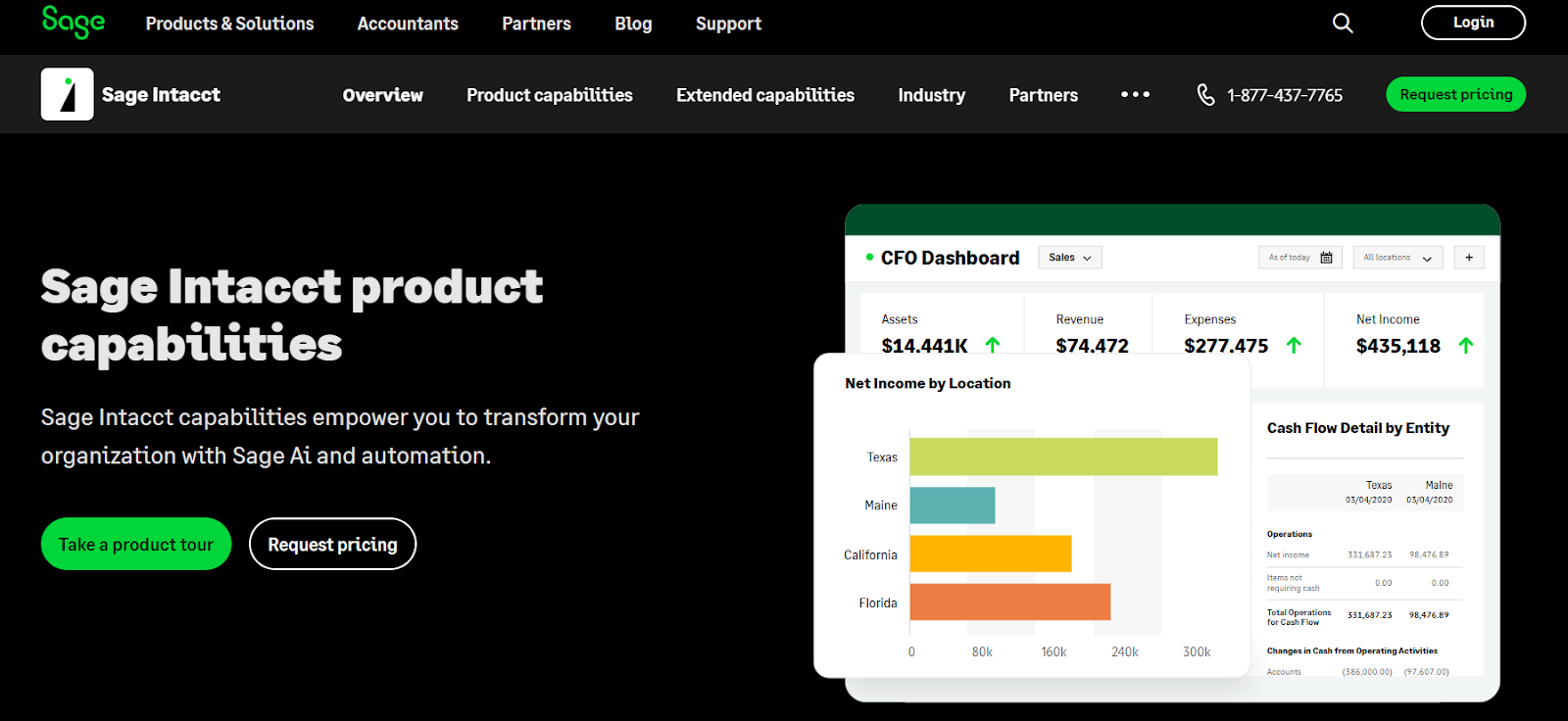

Unlike other tools discussed in this article, Sage Intacct isn’t merely an invoicing tool but a full-fledged cloud ERP system focused on automating complex financial processes. The platform excels in areas where businesses face significant complexity. For example, its multi-entity management capabilities allow companies with multiple business units, locations, or legal entities to automate financial consolidation in real-time.The platform integrates with numerous online payment gateways and enables instant payment collection directly from the invoice. While it works independently, it seamlessly integrates with other Zoho apps, such as Zoho CRM and Zoho Analytics.

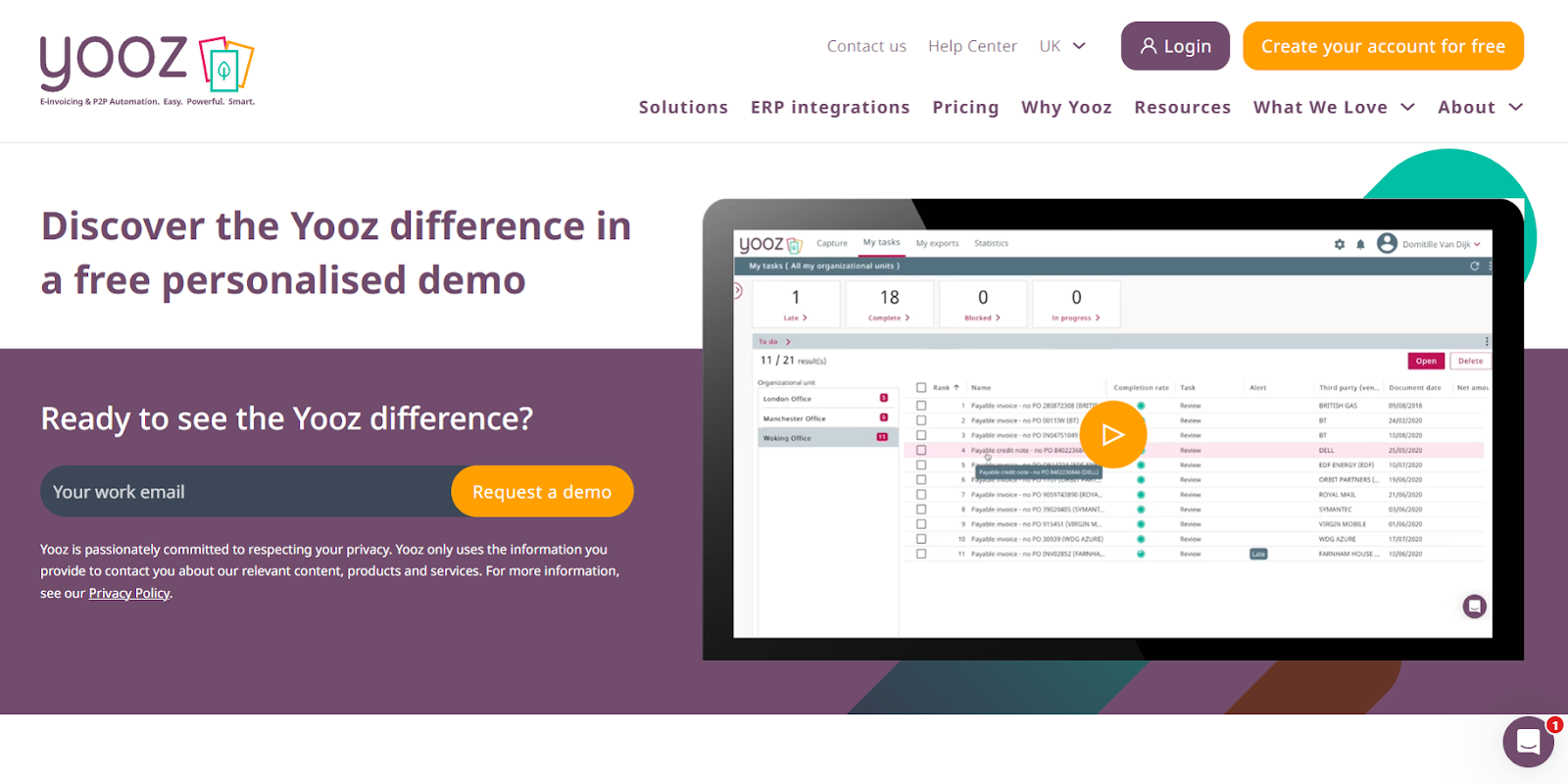

#3 – Yooz AP

The final cost is calculated per employee, per month (PEPM), with the AP Automation functionality added to a company’s main service package. Xero’s invoicing feature is not available as a standalone product but is a core component across all its subscription plans. Xero offers three tiered pricing plans: “Starter” at USD per month, “Standard” at USD per month, and “Premium” at USD per month. Each plan includes the core invoicing features, with higher tiers offering additional accounting functionalities.

Xero’s invoicing feature is not available as a standalone product but is a core component across all its subscription plans. Xero offers three tiered pricing plans: “Starter” at USD per month, “Standard” at USD per month, and “Premium” at USD per month. Each plan includes the core invoicing features, with higher tiers offering additional accounting functionalities.

Pricing and Subscription Plans

Suggested read: How To Migrate Away from cPanel Hosting (The Escape Guide)In addition to simple invoice creation, the tool is part of a broader freelance business management suite. When you create an invoice, the client is automatically saved in a simple client management system, and the platform also includes features for expense tracking and report generation.Odoo’s unique and flexible pricing model sets it apart from many competitors. The Invoicing app is part of the broader Odoo Accounting app.

#4 – Stampli

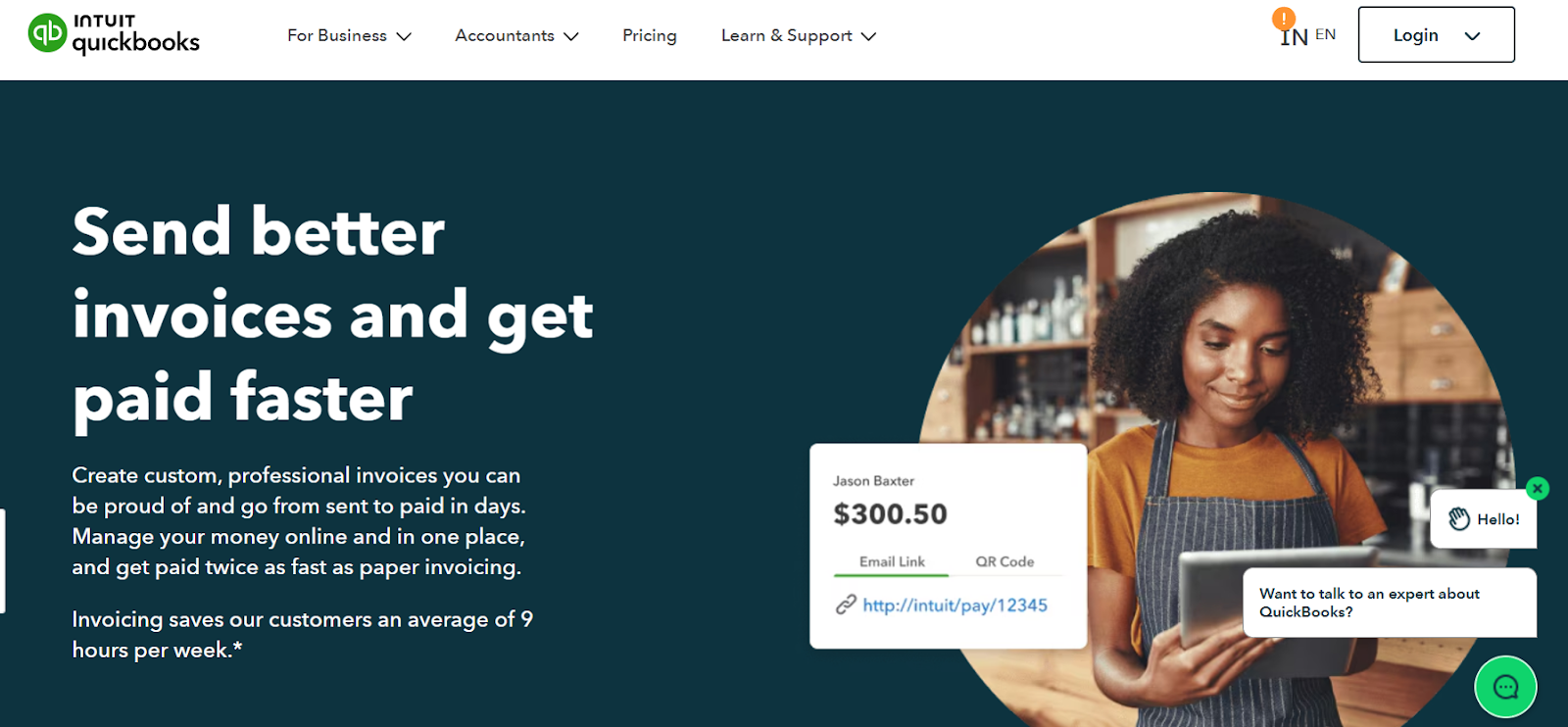

QuickBooks Invoicing is not a standalone product but an integrated feature within the comprehensive QuickBooks accounting software ecosystem. It is designed primarily for freelancers, small businesses, and mid-sized companies needing a unified billing and bookkeeping solution. The platform allows users to create professional, customized invoices with their own branding, send them directly to clients, and track their status in real time to see when they have been viewed and paid.With features like Workspaces, backups, server monitoring, and SSL management, you can manage all your client sites from one place while keeping costs under control. Combine the right invoicing tool with RunCloud, and you’ve got a complete operations setup – from sending the first invoice to maintaining the last website.When evaluating different invoice management platforms, not all are created equal. To ensure the software meets your business needs and can scale with you, focus on these essential features:

Pricing and Subscription Plans

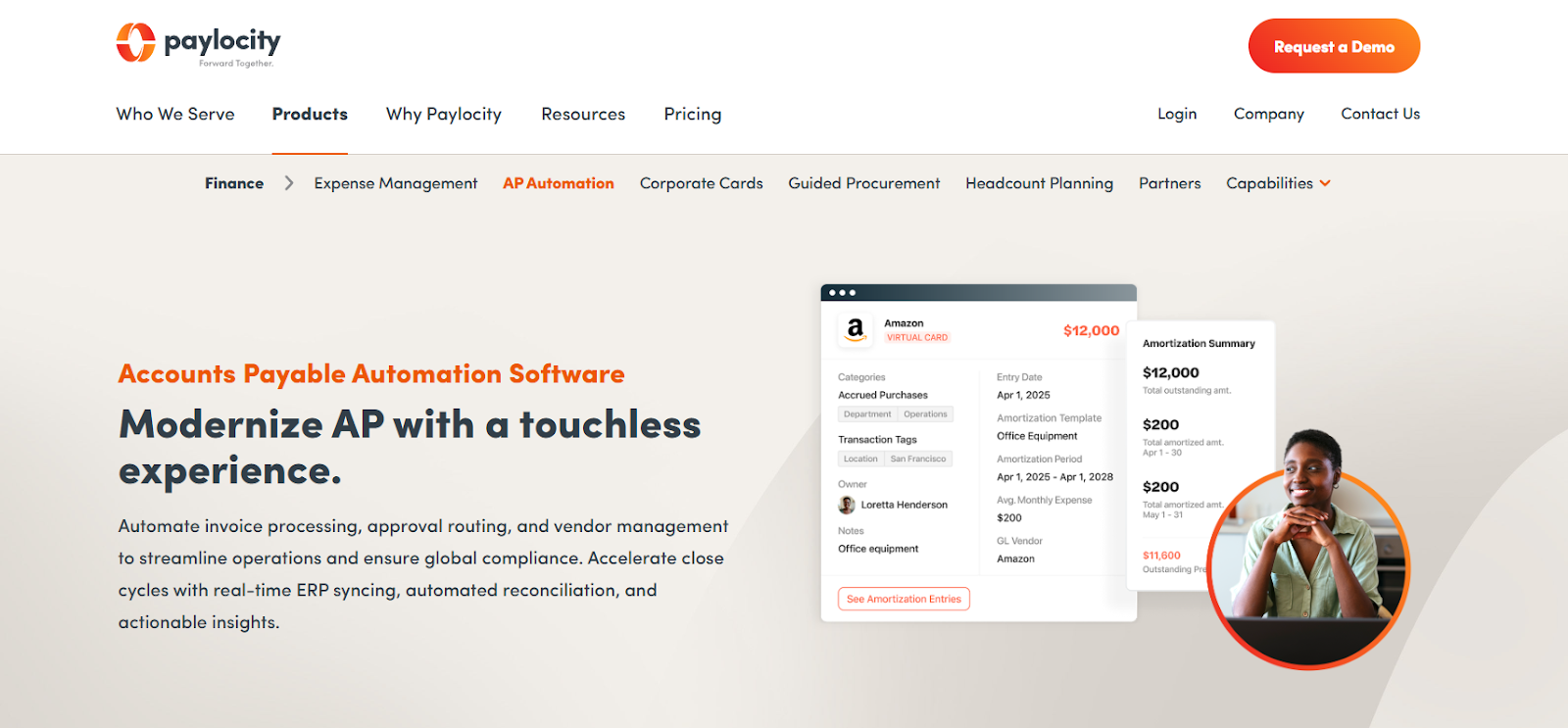

If you’re still sending invoices from Word documents, chasing late payments with awkward follow-up emails, or juggling endless spreadsheets, you’re wasting time you could spend on actual client work.Paylocity’s AP Automation solution is an integrated module within its comprehensive Human Capital Management platform. It is primarily designed for businesses seeking to unify their finance and HR operations under a single vendor, creating a seamless connection between employee data and financial workflows. The tool automates the standard accounts payable lifecycle, from invoice capture using OCR technology to setting up customizable, multi-step approval workflows that route invoices to the correct stakeholders.

- Invoice Volume: The number of invoices your business processes monthly or annually.

- Number of Users: The quantity of user seats required for your AP team, approvers, and other stakeholders.

- ERP Integration: The specific ERP system being used and the complexity of the integration.

- Feature Set: Access to specific advanced features or modules within the Stampli platform.

#5 – Paylocity

Yooz structures its pricing based on the yearly invoices you expect to process (e.g., up to 1,200, up to 6,000, etc.). This makes it scalable, allowing businesses to choose a plan that fits their current size and adjust as they grow.Sage Intacct is a cloud financial management and accounting platform designed for mid-market and enterprise-level organizations that have outgrown simpler accounting software.

Pricing and Subscription Plans

Suggested read: How to Edit robots.txt in WordPress (With & Without Plugin)The pricing structure is as follows:

#6 – QuickBooks Invoicing

Refrens offers a free online invoice generator for freelancers, consultants, and small agencies. The platform allows users to quickly create professional, customized invoices, with options to add a company logo, signature, and attachments. A significant highlight of the free tool is that the invoices generated do not carry any Refrens branding, a feature often reserved for paid tiers in other tools.Suggested read: How to Set Up a Hetzner Server with RunCloudSage Intacct also provides powerful, dimensional reporting and dashboards that give finance leaders deep visibility into performance metrics across various business drivers. This allows for sophisticated analysis without relying on cumbersome spreadsheets.

Pricing and Subscription Plans

The Lite plan starts at USD .10 per month, the Plus plan is USD .80 per month, and the Premium plan is USD .50 per month. These prices reflect a 90% discount for the first three months. After the initial three months, the prices will increase to , , and per month.

#7 – Vyapar E-Invoicing

Yooz is a “pure cloud” solution for accounts payable that emphasizes speed and simplicity in its end-to-end invoice and payment processing. The platform uses advanced technologies like AI, deep learning, and robotic process automation (RPA) to minimize manual intervention from invoice capture to final payment. One of its primary highlights is its sophisticated data extraction capability. It can accurately capture relevant information from any document format, including emails, PDFs, and scanned paper, without prior template configuration.The platform is designed to provide a complete workflow. After capturing an invoice, Yooz automatically handles GL coding, identifies duplicates, and initiates multi-level approval workflows that can be managed from any device, including a dedicated mobile app.

Pricing and Subscription Plans

Additionally, it can set up recurring invoices for retainers, send automated payment reminders for overdue accounts, and directly convert estimates into invoices, streamlining the entire sales cycle from proposal to payment.Swipe uses a clear, tiered subscription model with a free plan, making it highly accessible for new and emerging businesses. The pricing structure is transparently listed on their website and is designed to be affordable.

- Free Plan includes essential features like creating GST-compliant invoices, managing inventory, and generating e-invoices. It is a fully functional offering designed to cover the basic needs of a small business.

- Premium Subscriptions: Vyapar offers paid subscription plans starting at INR ₹3999/year (approximately USD $45) for businesses that require more advanced capabilities. These premium tiers unlock features such as multi-device synchronization (for using the app on both mobile and desktop), support for managing multiple businesses from a single account, and other advanced functionalities.

#8 – Swipe Invoicing & Business Management

Swipe uses a clear, tiered subscription model with a free plan, making it highly accessible for new and emerging businesses. The pricing structure is transparently listed on their website and is designed to be affordable.

- One App Free Plan: Odoo offers a plan to use a single application for free with unlimited users. Since Invoicing is part of the Accounting app, you can use the full Accounting suite (including invoicing) at no cost. This makes it an incredibly compelling option for small businesses and startups.

- Paid Plans (Standard and Custom): Odoo offers paid plans for businesses that need to use more than one Odoo application (e.g., combining Accounting with CRM, Inventory, and Project Management). These plans start at $19.90 per month, and they have a per-user, per-month fee that grants access to all of Odoo’s applications.

#12 – Xero

Swipe uses a clear, tiered subscription model with a free plan, making it highly accessible for new and emerging businesses. The pricing structure is transparently listed on their website and is designed to be affordable.

- Free Plan: The standard Zoho Invoice plan is free and allows businesses to manage a substantial number of customers (up to 1,000) and send unlimited invoices. It includes access to customizable templates, automated reminders, time tracking, expense management, and payment gateway integrations, making it one of the most robust free invoicing solutions available on the market.

- Zoho Books: While Zoho Invoice is free, businesses that require more advanced, double-entry accounting features (like a full balance sheet, bank reconciliation, and in-depth financial reporting) are encouraged to upgrade to a paid subscription of Zoho Books, which includes all the functionality of Zoho Invoice and much more.

#15 – Sage Intacct

It securely processes vendor payments via ACH, virtual card, or check and ensures that all data syncs with the general ledger in real time. By linking AP processes directly with its core HR and payroll systems, Paylocity provides businesses with enhanced visibility and a single source of truth. This improves data consistency and streamlines overall administrative tasks across departments.Here’s how most platforms handle the process from start to finish:One of its most valued features is the self-service client portal. It allows customers to view all their past and present invoices, approve estimates, and make bulk payments in one place, enhancing transparency and client relations.

Pricing and Subscription Plans

Tipalti offers a comprehensive invoice management solution as part of its broader accounts payable automation platform. The platform is designed primarily for mid-market and enterprise-level businesses that manage high volumes of invoices. It offers multiple methods for invoice capture, including email, a supplier portal, and OCR scanning, which can read and process invoice data with high accuracy.

Wrapping Up: Who Should Invest in Invoice Management Software in 2025

The pricing structure is as follows:The right invoice management software can handle all that for you – creating professional invoices in minutes, tracking when they’re opened and paid, and sending polite reminders automatically.Rossum provides an e-invoicing platform as a single solution designed to handle the complexities of modern businesses, particularly for companies operating across multiple regions. It uses sophisticated AI to automate the entire document lifecycle, from initial receipt to final processing. It also allows businesses to manage a hybrid reality where they receive both traditional PDF invoices and structured e-invoices.Vyapar operates on a freemium model, one of its key market differentiators. The core e-invoicing functionality is available as part of its free business accounting software, making it highly accessible for freelancers, sole proprietors, and small businesses needing GST compliance without an upfront investment.Vyapar is a business accounting application designed to meet the needs of small and medium-sized businesses in India. Its e-invoicing functionality is built to simplify compliance with the Indian government’s Goods and Services Tax (GST) e-invoicing mandate. The platform enables users to generate GST-compliant invoices and seamlessly register them on the government’s Invoice Registration Portal (IRP) to obtain the required Invoice Reference Number (IRN) and QR code.Tipalti also offers an advanced validation and approval system. The platform can perform two- and three-way PO matching and uses a powerful business rules engine to enforce internal controls, automatically routing invoices to the correct approvers. It also includes built-in compliance features, such as validating tax information (like W-9s and VAT IDs) before processing payments.